There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

12th December, 2025

Understanding how risk management functions within these layers is essential for institutions aiming to maintain stability, compliance, and sustainable growth.

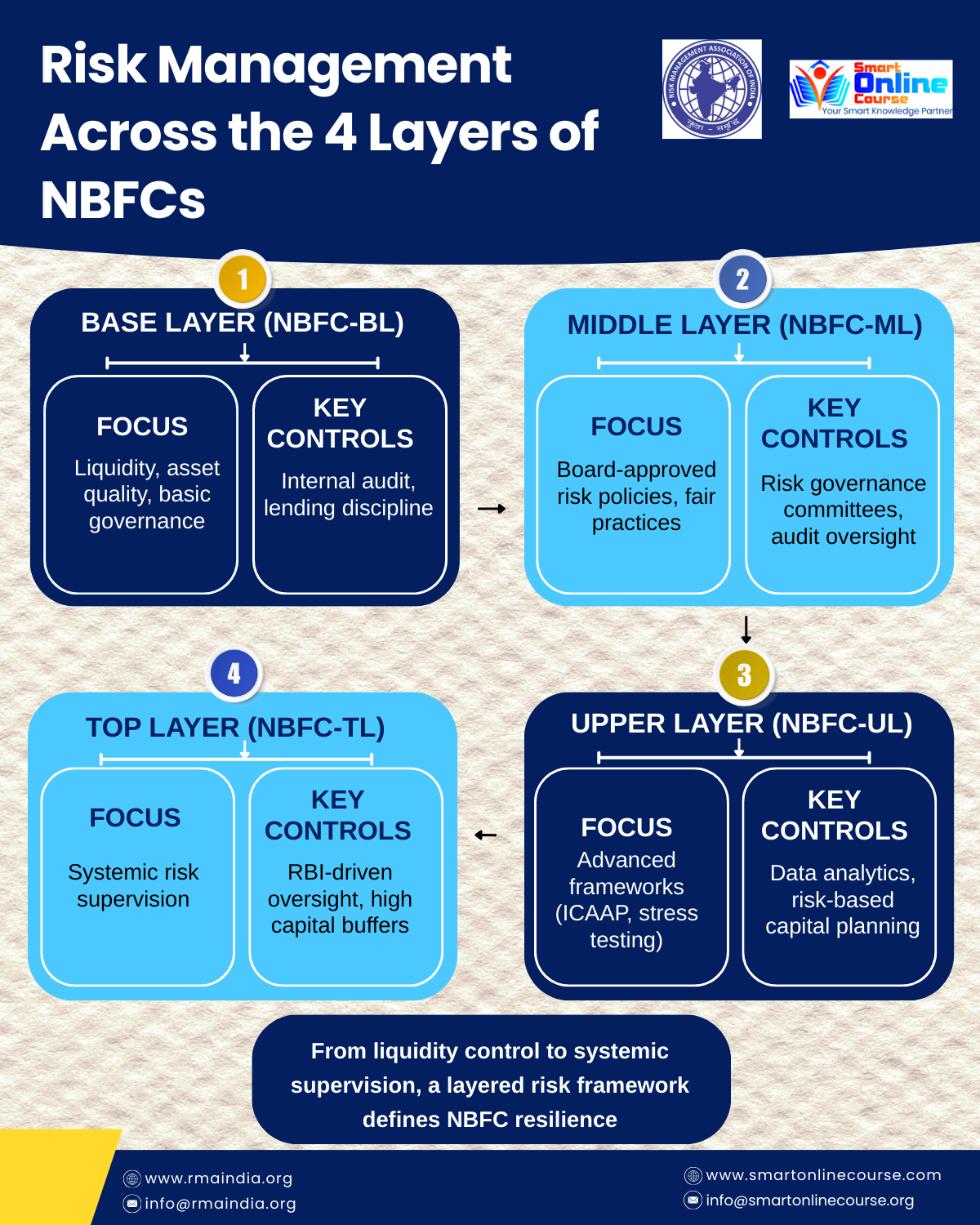

The RBI’s scale-based regulation (SBR) framework, introduced in 2021, categorizes NBFCs into the following four layers based on size, activity, and risk exposure:

While the degree of supervision varies, the core risk categories remain consistent:

RBI mandates NBFCs, especially those in the middle and upper layers, to adopt strong governance structures led by independent directors and specialized committees. Risk management functions must operate independently from business units, reporting directly to the Board’s Risk Management Committee (RMC).

Regular stress testing, early warning indicators, and risk-based internal audits are now standard expectations. The focus is shifting from reactive compliance to proactive governance that embeds risk awareness in strategic decision-making.

Effective NBFC risk management is regulatory and strategic. Leading institutions are aligning risk frameworks with business objectives by:

The path toward risk maturity in NBFCs is not without challenges. Smaller NBFCs often lack the technological infrastructure or skilled personnel to implement advanced frameworks. Additionally, evolving regulations, climate-related risks, and third-party dependencies add new layers of complexity.

To overcome these, NBFCs must invest in capacity building, risk analytics, and continuous professional upskilling. Collaborating with specialized training institutions can help bridge this knowledge gap and align practices with international standards.

Risk management is no longer a compliance checkbox. It’s the backbone of institutional resilience. NBFCs that embed robust, forward-looking frameworks will lead the sector’s transformation from reactive regulation to strategic sustainability.

As India’s financial sector evolves, institutions aiming to strengthen their risk and compliance frameworks can explore specialized courses like Enterprise Risk Management, Governance, Risk and Compliance, or Credit Risk Management offered by Smart Online Course, the training partner of RMAI.