There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

19th December, 2025

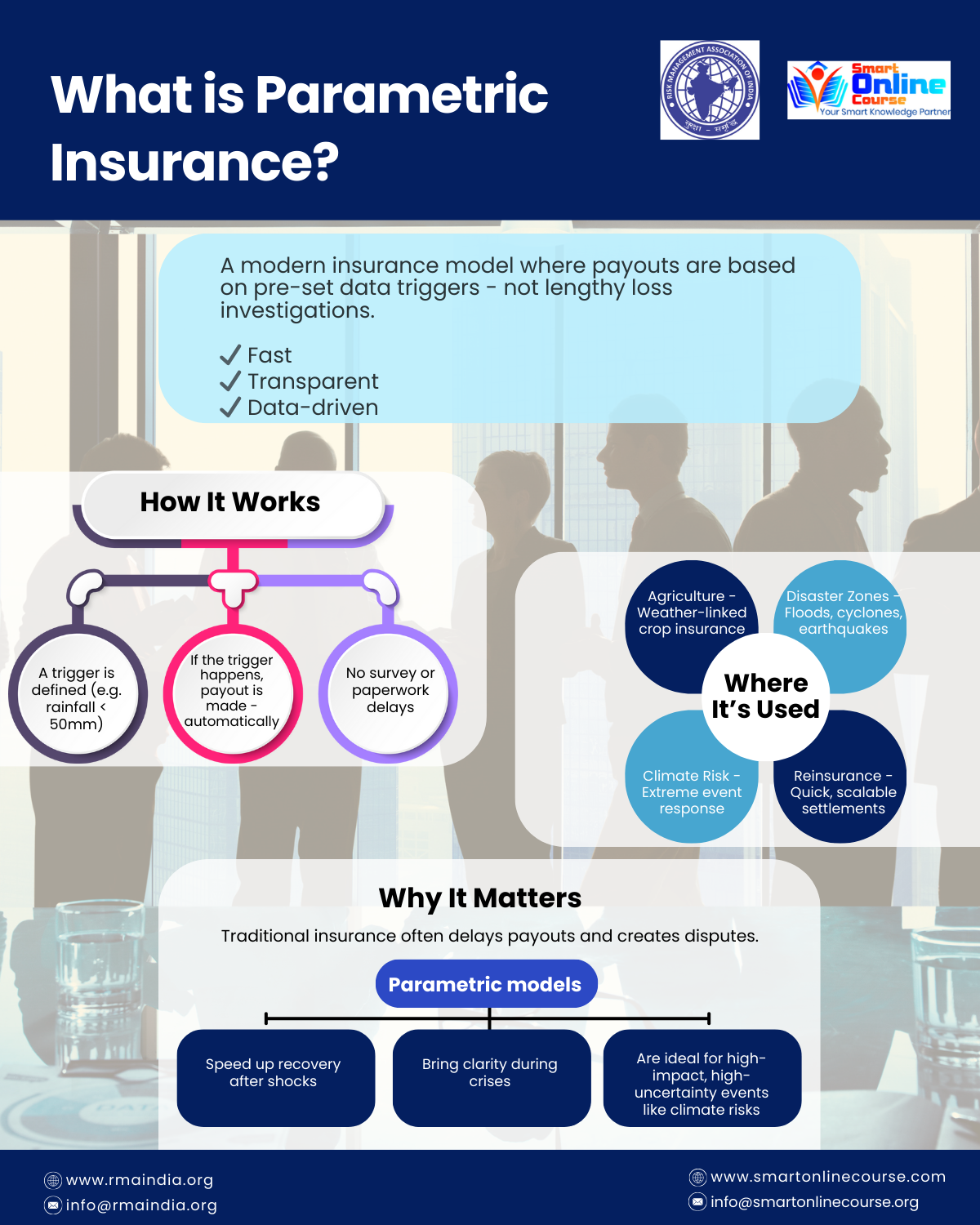

Traditional insurance models are built on loss assessment, claims verification, and post-event settlement. While effective, these processes often result in delays, disputes, and administrative costs, particularly in high-impact, low-frequency events such as natural catastrophes. Parametric insurance addresses these limitations by redefining how risk is measured, transferred, and settled.

As climate volatility, supply chain disruptions, and operational risks intensify, parametric insurance is emerging as a critical innovation in the global insurance ecosystem.

Parametric insurance is a risk transfer mechanism where payouts are triggered automatically when a predefined parameter or index crosses a specified threshold. Unlike indemnity insurance, payouts are not linked to actual loss assessment.

The trigger may include measurable data points such as rainfall levels, wind speed, earthquake magnitude, temperature deviations, or commodity price indices. Once the trigger condition is met, payment is released without claims investigation.

The structure of parametric insurance is built on four core components:

| Aspect | Traditional Insurance | Parametric Insurance |

| Claims Process | Loss assessment required | No loss assessment |

| Settlement Time | Weeks to months | Days |

| Dispute Risk | High | Minimal |

| Basis Risk | Low | Present but manageable |

| Administrative Cost |

High | Lower |

While parametric insurance introduces basis risk, the efficiency gains often outweigh this limitation when structured correctly.

Parametric insurance is increasingly applied across sectors:

Parametric solutions require a different skill set compared to conventional insurance products. Professionals must understand data modeling, trigger design, contract structuring, regulatory considerations, and client suitability assessment.

As insurers, reinsurers, brokers, and risk managers expand their parametric offerings, demand is growing for professionals who can bridge actuarial logic, data analytics, and practical risk transfer design.

For insurance and risk professionals, parametric insurance is no longer a niche concept. It is becoming a mainstream component of enterprise risk management and climate risk solutions.

If you want to understand how parametric insurance products are structured, priced, and deployed in real-world scenarios, the Parametric Insurance course by Smart Online Course, in partnership with RMAI, provides structured, industry-relevant learning designed for working professionals. The course focuses on practical frameworks, use cases, and decision-making insights that are increasingly essential across the insurance value chain.

👉 Explore the course here: Parametric Insurance