There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

23rd January, 2026

Carbon credits are no longer just an offset tool for corporate sustainability pledges. In 2026, compliance mechanisms, regulatory frameworks, and market structures are set to undergo systemic changes that will redefine how businesses generate, trade, and report carbon credits. These shifts are anchored in policy reform, technological innovation, and evolving international markets, compelling companies to rethink their carbon strategies.

One of the standout developments influencing 2026 is the movement toward integrated carbon compliance frameworks across key jurisdictions. Following COP30, the Open Coalition on Compliance Carbon Markets aims to align emissions trading systems and accounting standards across regions such as the EU, China, and Brazil. This trend will enhance carbon market interoperability and liquidity while reducing fragmentation across compliance schemes.

From January 1, 2026, the Carbon Border Adjustment Mechanism (CBAM) in the European Union enters a more operational phase. CBAM imposes carbon compliance requirements on imported high-carbon goods such as steel, cement, and aluminum, meaning exporters to the EU must prove emissions data and carbon compliance or pay corresponding carbon costs.

For manufacturers and exporters in Asia, Africa, and the Americas, this presents both compliance challenges and opportunities to build low-carbon competitive advantages.

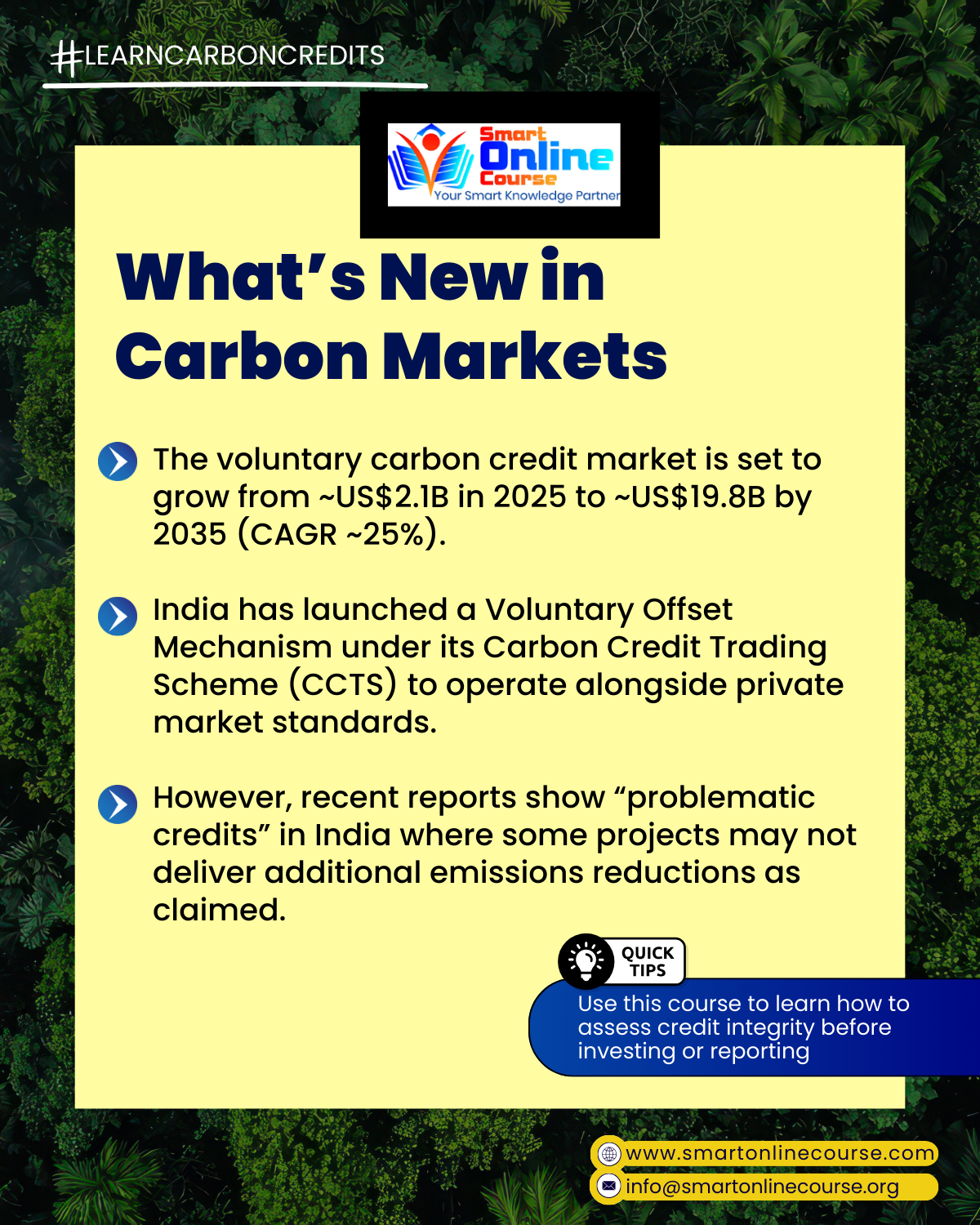

Countries across Asia-Pacific and other regions are either launching or expanding compliance carbon trading systems. China’s national ETS continues to broaden its sector coverage, while India’s Carbon Credit Trading Scheme (CCTS) moves toward issuance and trading from 2026, with sectoral targets, registry enhancements, and compliance deadlines.

Also Read: Risk Management Frameworks to Learn in 2026

The carbon marketplace is shifting from cheap avoidance credits toward high-integrity removal credits such as direct air capture, BECCS, and engineered solutions. Scarcity of removal credits is driving upward pricing pressure, and demand from compliance frameworks that value permanence and measurable impact is intensifying.

While voluntary carbon markets (VCM) once operated separately, 2026 is seeing a convergence where compliance considerations influence voluntary pricing and vice versa. Larger corporations seeking compliance alignment are increasingly purchasing credits that adhere to strict integrity standards.

Carbon credits are rapidly transforming into tradable financial instruments, including exchange-traded futures and carbon-linked funds, improving price discovery and institutional participation.

Also Read: Top 10 Skills For 2026 That Will Shape The Future Workforce

Companies preparing for compliance obligations in 2026 must consider multiple fronts:

Robust MRV (Measurement, Reporting, and Verification) systems are indispensable. They ensure accurate emissions data, meet reporting standards, and support credit issuance and compliance obligations under evolving frameworks such as Article 6 and linked ETS systems.

Businesses should register with credible registries, adopt high-integrity credits, and align internal reporting with international compliance standards to avoid double counting and ensure market credibility.

For export-focused companies, integrating CBAM readiness into operational processes - especially data capture on emission intensity across supply chains, is critical.

Ready to Lead in Carbon Compliance?

If your organization is navigating these regulatory shifts and needs strategic, expert guidance, explore the Carbon Credit Framework, Accounting & Reporting Certificate course at Smart Online Course. Gain practical skills in compliance mechanisms, carbon accounting, MRV frameworks, and market engagement strategies. Enroll now and secure your carbon leadership advantage in 2026.

Also Read: Future Job Roles in 2026: What They Look Like and What Skills They Need

Identify coverage under current carbon regulations and map future compliance exposures (ETS participation, border rules, national schemes).

Set up cross-functional teams to manage data collection, emissions verification, and carbon credit filing.

Factor carbon compliance costs and opportunities into CAPEX, supply chain design, and sustainability reporting.

2026 is a transformative year for carbon credits and compliance. To thrive in this evolving ecosystem:

Explore Online Certificate Course on Carbon Credit Framework, Accounting and Reporting